What is Tax Planning?

Taxes can make a big dent in your annual earnings if left unplanned. To mitigate this, Tax planning is an outstanding way to reduce your tax liability in a financial year by utilising tax exemptions, deductions and benefits offered by the Income Tax authorities.

The exact definition of Tax Planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible.

Why Tax Planning?

Tax Planning is an essential part of financial planning. This helps in saving on taxes while conforming to legal obligations and requirements of Income Tax Act, 1961. One of the objectives of tax planning is to save money and mitigate one’s tax burden.

Benefits of Tax Planning

Here are few benefits of Tax Planning-

1. Reduce Tax Liability- Every taxpayer wants to reduce their tax burden and save money. One can reduce the payable tax by making investments in the various options offered under the Income Tax Act,1961. There are several schemes that can reduce your tax liability.

2. Economic Stability- Taxpayers’ money gets invested for the betterment of the country. Tax planning provides an inflow of money that results in the progress of the economy. So, this benefits both the citizens and the Government.

3. Promote Productivity- Tax planning’s major goal is channeling funds from taxable sources to different income-generating plans. The optimal use of funds is ensured for productive causes.

4. Minimize Litigation- Often there is a friction between the taxpayers and the tax collectors. As the Tax collector attempts to tax the maximum amount possible whereas the taxpayers desires to keep tax liability to a minimum. Minimizing the litigation saves taxpayers from legal liabilities.

Top 10 Tax Saving Tips for FY 2021

1. National Pension Scheme( NPS)

National Pension Scheme is a long term investment plan for retirement under the purview of the Pension Fund Regulatory and Development Authority(PFRDA) and Central Government.

You can claim a deduction of up to Rs 1.5 lakh for NPS – your contribution as well as the employer contribution. 80CCD(1) covers self contribution, part of section 80 C. The maximum deduction one can claim is 10% of salary. For the self employed segment this limit is set at 20% of gross income. There is an additional exemption available upto Rs.50,000 under section 80 CCD(1B)over and above the 150,000/- limit.

So, you can claim tax deduction up to Rs 2 lakh simply by investing in NPS – Rs 1.5 lakh under Section 80C and another Rs 50,000 under Section 80CCD (1B). That means if you fall under the tax bracket of 30 percent, you can save Rs 62,400 in taxes.

2. Deduction on Interest Paid on a home loan

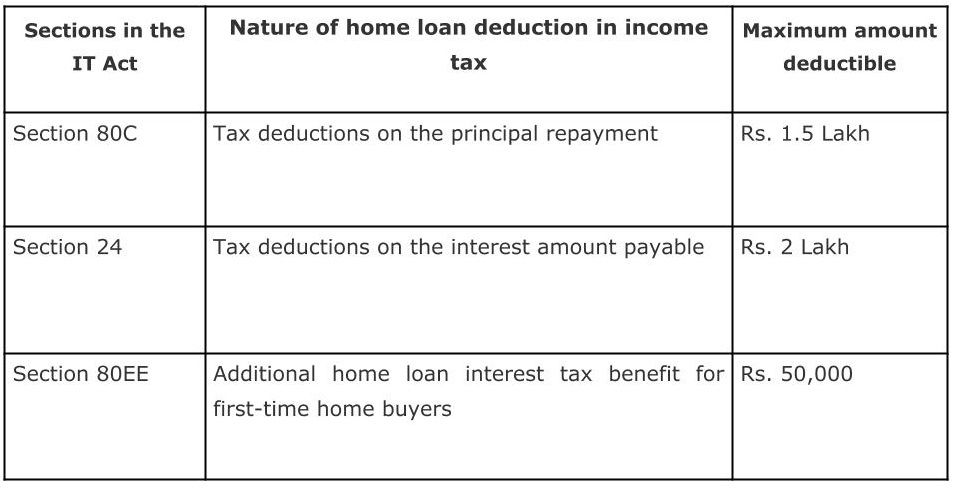

Interest on Home loan paid up to 2 lakhs can be claimed as deductions under section 24 of the Income Tax Act.

You can claim a deduction of the principal amount up to a maximum of 150000 under section 80 C.

Sections of the Income Tax Act that provide tax rebate on home loan:

As a family or in case of 2 borrowers, you will be able to take a larger tax benefit against the interest paid on the home loan when the property is jointly owned and your interest outgo is more than Rs 2,00,000 per annum.

3. Instruments for Tax Saving-ELSS

Equity Linked Saving Scheme or ELSS is a type of mutual fund scheme that invests in the equity market. It is a tax saving instrument. These funds invest in stocks of listed companies in specific proportion according to investment goals. These funds aim to appreciate capital in the long run. Fund managers managing the scheme pick the stocks and invest in the market.

Advantages of investing in ELSS- Short Lock in period, higher returns, better post tax returns, Hassle free and convenient Investing. The maximum amount claimed under section 80 C deduction is 1,50,000. There is a lock-in of 3 years, yet, you may choose to remain invested for a long term.

ELSS offers better post-tax returns than other 80C investments because long term capital gains of up to Rs. 1 lakh a year from ELSS mutual funds are exempt from income tax and long-term capital gains above Rs. 1 lakh are taxed at 10%

4. FDs, Endowment plans, and ULIPS

These too are tax-saving instruments but are not worth your money. These products provide low returns and are not tax efficient. The lock in period for these schemes is high. Charges are levied if one wants to take out the investment before the lock in period.

5. Insurance

Life Insurance

Premium paid on life insurance policy like endowment, whole life, money back policies and ULIPS can be claimed as a deduction under section 80C of Income Tax Act,1961.

Maximum deduction claimed can be 1,50,000.

Section 80 CCC provides tax deduction for annuity plans from insurance companies for the purpose of receiving pension. The maximum deduction claimed can be 1,50,000

Section 10(10D) allows exception on the amount which you have received from the insurance company. The sum assured and bonus happens to be tax free on surrender of policy or unforeseen situations like death. The receiver gets the tax free amount, subject to certain conditions.

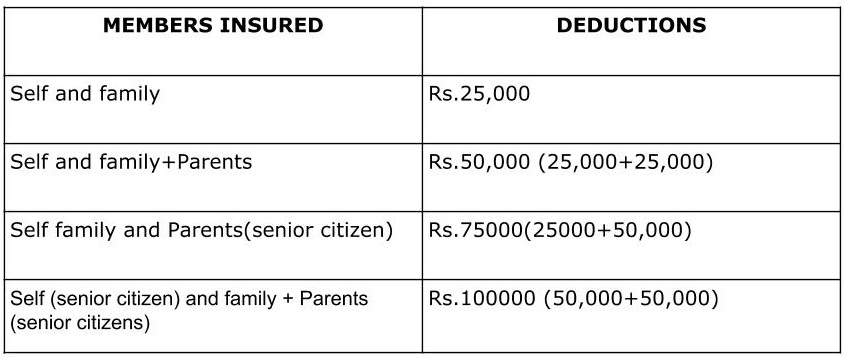

Health Insurance

Under section 80 D of Income Tax Act,1961 Tax deduction can be claimed for premiums paid for health policy.

6. Emergency Fund

Opt for liquid mutual funds to park your money for emergencies. These plans offer better returns than a savings bank account and are very accessible too.

7. Start collecting bills/receipts

You may have opted for different benefits in your salary structure, such as Medical Expenses, Mobile phone bills, Leave Travel Allowance, etc. You would be required to show proof of payments for the same at the end of the year, so it would be prudent to keep all payment proofs, bills, etc safe.

8. Charity

Contributions made to certain relief funds and charitable institutions can be claimed as a deduction under Section 80G

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.

9. Education Loan

Tax savings on repayment of an education loan is under Section 80 E. This benefit can be claimed by the child or the parent depending on who repays the education loan.

For the total EMI paid on the loan, you can claim Rs. 48,000 for the financial year as tax deductions. You can only claim education loan tax savings or tax deductions for a maximum of 8 years.

10. Disable dependent under section 80 DD

Tax savings can be done on medical expenses towards disabled dependent under section 80DD.

Dependents who have a minimum of 80% of any disability are regarded as persons with severe disability, and the individual who incurs costs on the medical expenses of such a dependent can claim a deduction up to Rs. 1.25 lakh

Tax planning if performed within the Income Tax framework, is legal. Any shady technique might land you in trouble. As a responsible citizen, it is our responsibility to plan our taxes according to our tax slabs, personal choice, and social liabilities. There are various schemes available to choose from.

As a taxpayer one thing that you must keep in mind is, Money Saved is Money Earned.

Looking for customized tax planning? Or wish to assess your risk profile, connect with our wealth custodians today. Write to: invest@rurashfin.com