Initial public offering (IPO) is the process by which private corporations offer shares to the public in a new stock issuance. So basically, it’s the process by which private corporations can raise capital from public investors. And after the initial share sale, the corporation is no longer privately held. If you are looking to participate in upcoming IPOs and want to have a better understanding of the process, this compiled list of the frequently asked questions regarding IPOs will help you! Have a look at the Frequently Asked Questions on IPO –

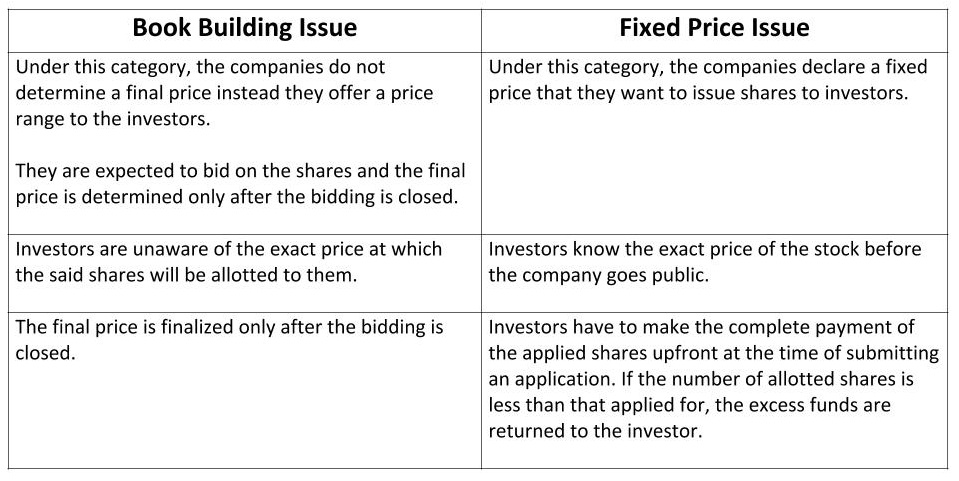

Q. What is the Difference Between Book Building Issue and Fixed Price Issue?

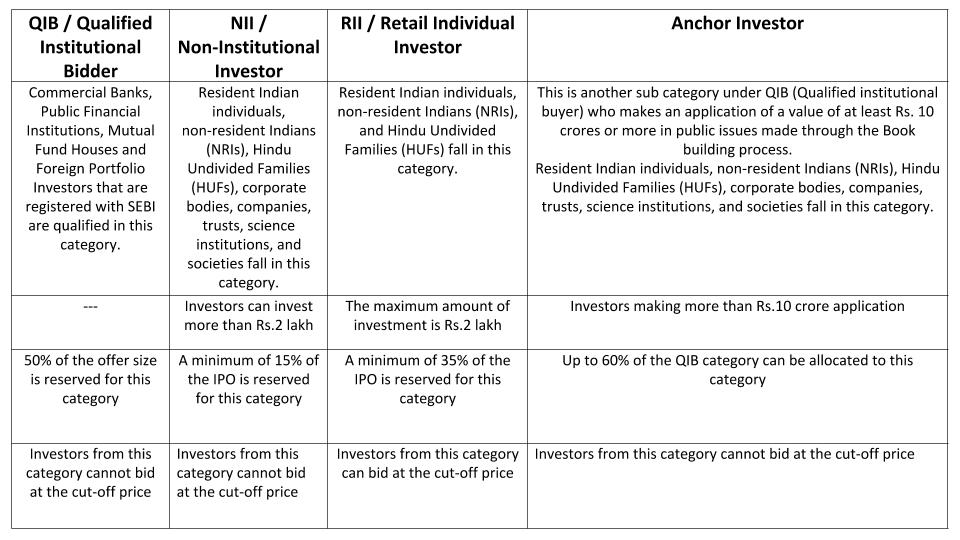

Q. What is the Difference Between RII, NII, QIB, and Anchor Investor?

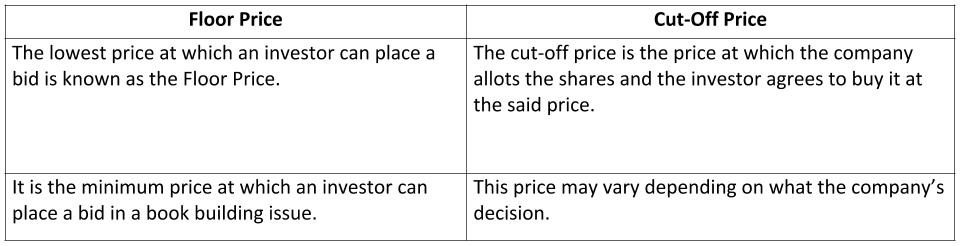

Q. What is the Difference between Floor Price and Cut-Off Price for a Book Building Issue?

Q. Is it mandatory to have a PAN Number to Apply in an IPO?

Yes, it is mandatory to have a PAN Number to apply for an IPO.

Q. What does ‘DP’ stand for in an IPO Online Form?

In the IPO form, DP stands for Depository Participant.

In India, there are two categories of Depositories – The first category is the National Securities Depository Limited or NSDL and the second category is the Central Depository Services Limited or CDSL. Each depository has a network of depository participants which are the link between depositories and companies that issue securities. A DP can be a financial institution, bank, brokerage house, etc. registered with the Securities and Exchange Board of India (SEBI). An investor opens a demat account with a DP and the name of the same needs to be specified on the form under DP and the DP ID.

Q. What is ‘Market Lot Size’ & ‘Minimum Order Quantity’ for an IPO?

‘Market Lot Size’ or ‘Minimum Order Quantity’ is the specification made by any company launching an IPO. The specification denotes the minimum number of shares that an investor can apply for. This is also known as the IPO bid lot.

Q. How many days will an IPO remain open for the Public?

It is mandate for an IPO to remain open for at least three working days. The maximum duration cannot exceed ten working days. In case of a book building issue, the IPO remains open for three to seven days. This can be extended by three days if the price band is revised.

Q. What is the Basis of Allocation or Basis of Allotment in an IPO?

Basis of Allocation or Basis of Allotment is a document to stock exchanges and investors published by the Registrar of an IPO. The document provides important information about the final price of the IPO, demand or bidding information, and the share allocation ratio. The document is categorized based on the categories of investors (RIIs or the Retail individual investors, NIIs or the Non-Institutional Investors, and QIBs or the Qualified Institutional Buyer) and the number of shares applied for. Investors can also get a detailed view of the IPO including information regarding the total number of valid applications received and allocation details.

Q. Can I apply for an IPO through multiple applications on the same name?

No, you cannot apply in an IPO through multiple applications with the same name. In fact, if you try doing it, then all the applications made under the same name will be rejected. However, you can apply in the name of different family members.

Q. The maximum subscription amount for Retail Investors is limited to Rs. 2 lakh. What’s the reason?

SEBI (The Securities and Exchange Board of India) has classified investors into three broad categories – RIIs or the Retail individual investors, NIIs or the Non-Institutional Investors, and QIBs or the Qualified Institutional Buyer. And a fixed percentage of the IPO is reserved to each category. They are –

RII – 35% of the IPO

NII – 15% of the IPO

QIB – 50% of the IPO

The reservation was to ensure that all categories of investors get an opportunity to participate in the IPO of a company. Based on their research, SEBI decided to cap the investment amount at Rs.2 lakh for an investor to qualify as a retail individual investor and they directly govern the allotment methodology in this category to ensure that maximum number of retail investors receive the allotment. To ensure that the shares reach the masses, the amount was capped at Rs.2 lakh.

Q. What is the process to withdraw from an IPO?

The process is simple. Follow the below mentioned steps

- Login to the broker’s account from where the application is made

- Go to the order book

- Select the specific IPO and choose to withdraw

- The amount that was blocked for the application will be released within a few days

It’s important to note, you can withdraw only during the bidding period. If the IPO does not have an online withdrawal option, then you need to contact the broker/bank through whom you have applied.

Q. How is the Cut-off Price of IPO decided?

The cut off price of the IPO is decided after considering the book and analyzing the market’s response to the stock. The decision is taken by the company and the book running lead managers (BRLMs).

Q. Is it possible to sell the stock allotted to an investor in an IPO even before the Stock gets listed?

Before the stock gets listed, one cannot sell the stock allotted to him.

Q. How many lots in an IPO should I apply to get a maximum allocation in the Retail Category?

This is an investor-specific decision and there is no fixed rule for it. Will help you with an example:

In case, if an IPO is oversubscribed, then SEBI (The Securities and Exchange Board of India) mandates the company to allot a maximum of one lot per investor using a lottery-based system. Which means, if your name is selected via the lottery system you can get a maximum of one lot.

For better understanding of allocation, it’s best to understand the mandates as basics from an investor advisor.

Q. How many IPO Applications can be made from One Bank Account using ASBA?

SEBI (The Securities and Exchange Board of India) Guidelines permit a maximum of five applications per investor from one bank account per issue using ASBA.

Q. What’s the timeline for receiving Credit for IPO Shares in the Demat Account?

There’s no fixed timeline – it varies from company to company. However, you should receive a credit of the shares applied for in an IPO in your Demat account before the listing date of the said shares.

Q. Can I apply for an IPO through the ASBA Facility of my bank or do I need a Trading Account?

Yes, you can apply for an IPO through the ASBA facility of your bank without having a Trading Account. Although, you will need a Demat account to receive a credit of the allotted shares.

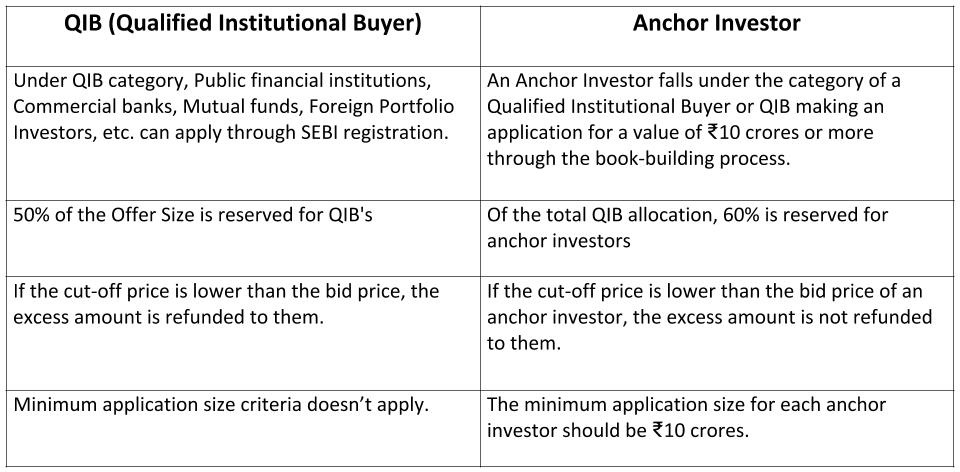

Q. Difference between QIB and Anchor Investor

Q. Can I apply for an IPO using the BHIM Application?

Yes, you can definitely apply for an IPO using the BHIM Application. SEBI (The Securities and Exchange Board of India) has permitted the use of UPI ID (you can create the ID using the BHIM application) for IPO application.

Q. How to apply for an IPO using the BHIM Application?

You can create an UPI ID using the BHIM application for IPO application. At the time of filling the application form, simply specify your UPI ID and submit it. Once submitted, the broker will send a request for blocking the funds on your UPI mobile application. You need to log in to the BHIM application and approve the block mandate request.

The amount applied for will be blocked in your bank account. Post-allotment of the shares, the exact amount is debited and the balance is unblocked.

Hope we have answered most of your questions. It’s time you get started!