How does it work?

What are Mutual Funds' Investments all about?

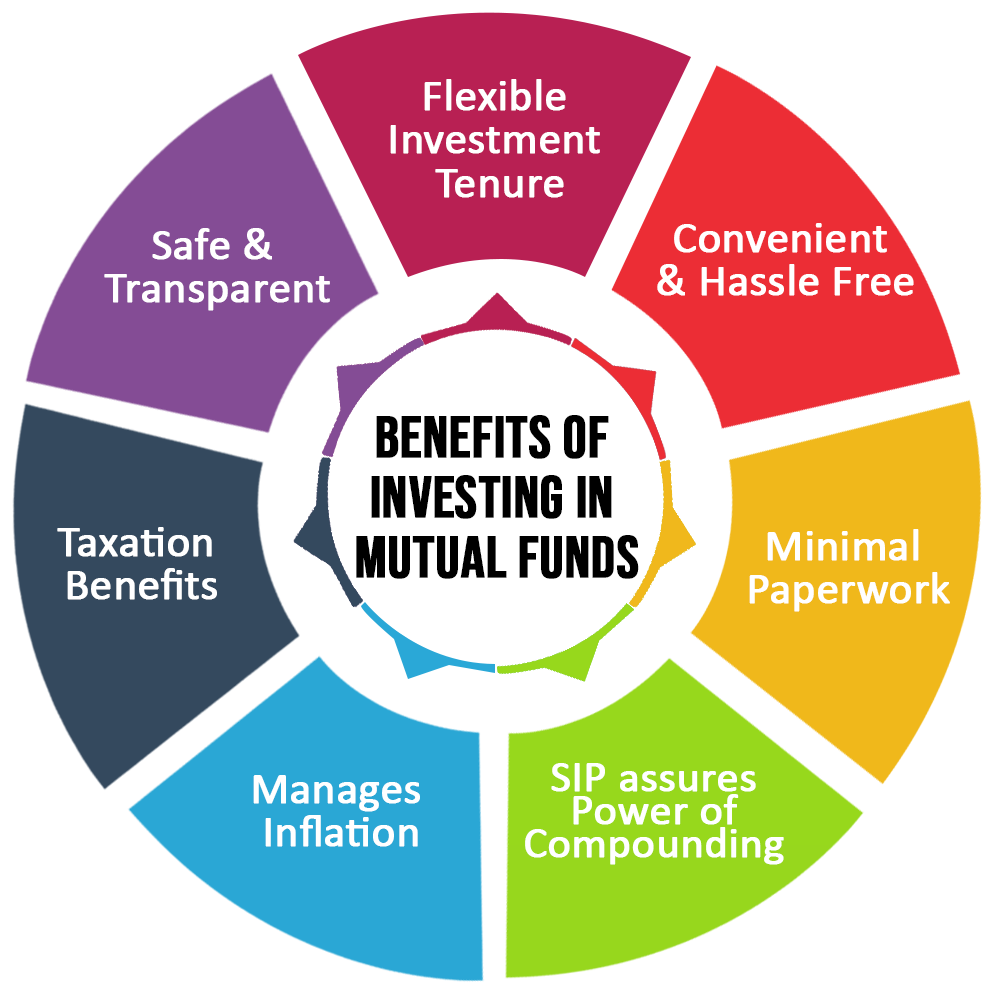

Mutual Fund is an investment vehicle made up of capital/corpus collected from various owners and risk-takers. Units are issued to the investors in the proportion to their investments.

Have more questions? Connect

Mutual Fund categories for Diversification

There are pure Large Cap Funds, Core Diversified Funds, Multi Cap/ Focused Funds, Sector/ Thematic Funds, Value Funds/ Contra Funds in variety.

These funds give capital growth over the long term and stable wealth by offering the best of equity & debt. Arbitrage Funds, Balanced Hybrid, Equity Savings & Dynamic Asset Allocation are various types of hybrid schemes.

They invest in fixed-income securities like Government & Corporate Bonds, Treasury Bills, Commercial Papers etc. Dynamic Bonds, Credit Risk Funds, Monthly Income Plans (MIPs) and Fixed Maturity Plans (FMPs) are also types of debt funds.

Equity Linked Savings Schemes (ELSS) are open-ended in nature. They offer tax benefits to investors under Section 80C. The minimum lock-in period for these funds is 3 years.

A type of fund that culminates stocks that track an underlying index and is traded on stock exchange. An ETF holds assets such as equity stocks, bonds and commodities.