ABOUT THE COMPANY

Tamilnad Mercantile Bank (formerly known as The Nadar Bank) initially set up for Nadar Community now has reach across all communities in India. It has one of the strongest financial position and it boasts of a remarkably high CAR as per Basel II norms. With initial capital base of Rs 5 lacs today TMB has crossed a net worth of Rs 44 Bn as on March 2021. It has emerged as a fastest growing schedule bank in India serving 4.5 million customers across 16 states and 4 union territories.

K.V. Rama Moorthy is the MD and CEO of the company.

RESULT HIGHLIGHT

OUR INTERPRETATION

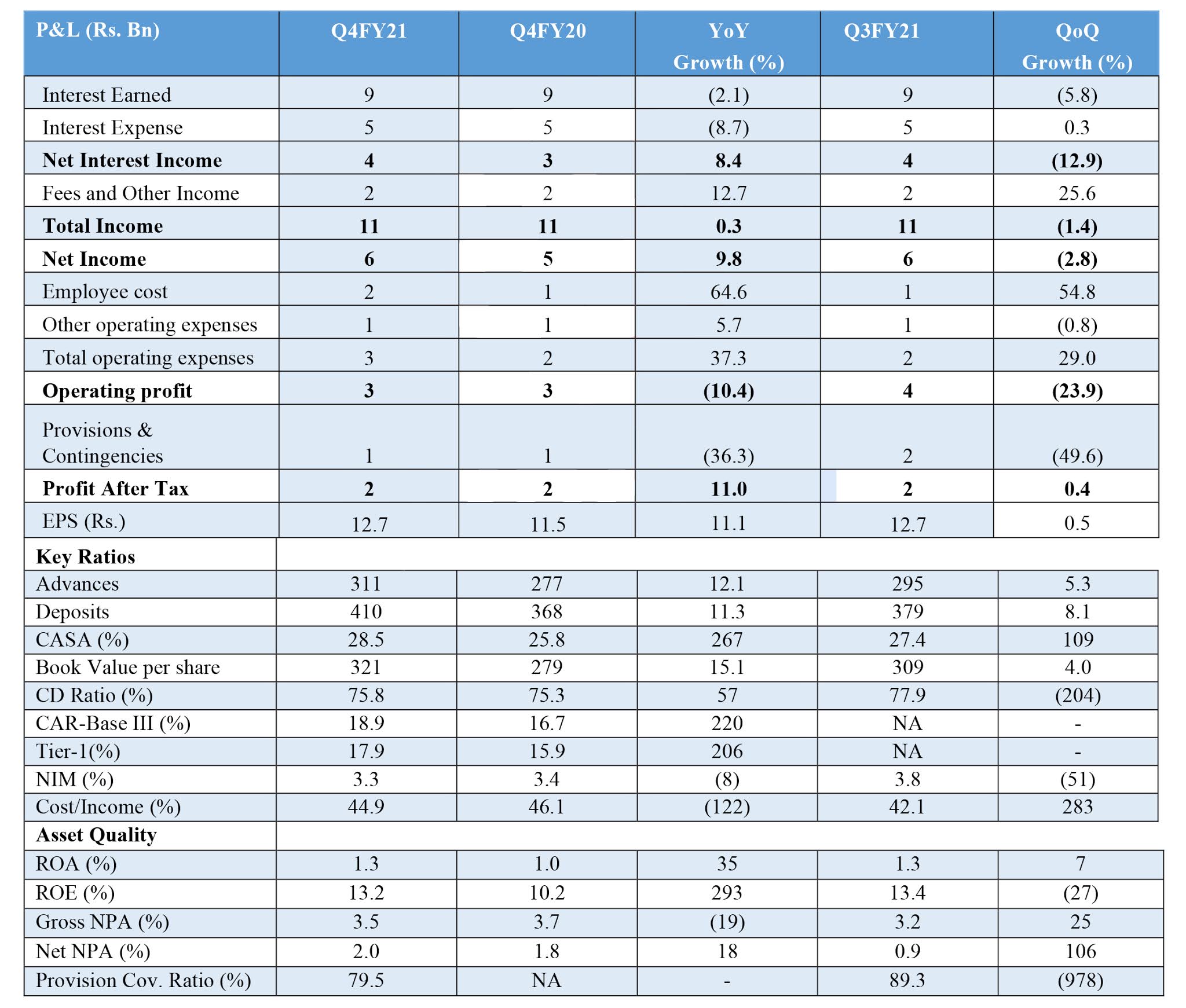

TMB has shown consistent improvement in its performance over the last 5 years. In this quarterly result, we have seen a drastic jump in the CASA ratio to 28.5%, signifying a growth of 267 bps and 109 bps on a y-o-y basis, which indicates the management’s continuous efforts to reduce its cost of funds and will lead an improvement in NIMs going ahead. Also, the advances and deposits in the quarter have shown 12.1% and 11.3% growth y-o-y, which is commendable in this pandemic situation given the company’s limited geographical presence. TMB has ended the year with a total business of Rs 720 Bn, a growth of 11.6% from the last year. Return ratios have also shown improvement with ROE of 14.0% and ROA of 1.3% for the year. Asset quality has also been steadily improving since last few years, with retail book growing and we believe this trend will continue.

TMB is one of the strongest bank in South India, with a proven track record. The CAR of 18.9% is well above the regulatory requirement and points towards the management’s prudent policy against the unforeseen bad loans, simultaneously focusing on growth. The company is planning to go for IPO worth Rs 10 Bn, which will be a combination of fresh capital along with OFS and we believe the IPO range can be in the range of Rs 600-650.

DISCLAIMER

This article is prepared by CA Shraddha Jain, Senior Research Analyst – Unlisted & Private Equity, on April 30, 2021. The views expressed herein are based on the facts and assumptions indicated in the document.

All investment / financial opinions and/or views expressed herein are the personal views of the author. All the information contained herein is to be construed as indicative data which has to be corelated with actual market and economic conditions.

It is very important for investors to do their own analysis before making any investment. The investor should take independent financial advice or independently research and verify, any information herein. The information contained in the report is not intended as, and shall not be understood or construed as, financial advice.

Unintended and misprints may occur despite best efforts to ensure that all information is accurate and up to date.

Please remember at all times that –

- Investment in unlisted securities is subject to market risks.

- Unlisted securities do not offer an easy exit route, such as selling on stock exchange, as in the case of listed securities.

- Any future gains or losses indicated herein are projections, based on our understanding of the market and macro-economic situation as well as our understanding of the enterprise issuing the unlisted securities, as on the date of this communication. Future course of events may change the projections. We do not assume responsibility to update this report based on such changes.

- We do not guarantee any profits, losses or rate of return.

Connect with our team of experts to know all about Tamilnad Mercantile Bank Limited now. Call now or drop a mail to invest@rurashfin.com.